gst claimable expenses malaysia

Get 10 family discount if 2 or more members are covered in a single Optima Secure policy on an individual sum insured basis Long Term Discount. Malaysia Office Location M1-7-7 8trium Tower Office Jalan Cempaka SD125 PJU 9 Bandar Sri Damansara 52200 Petaling Jaya Selangor Singapore Office Location 60 Paya Lebar Road 12-26 Paya Lebar Square Singapore 409051.

Royal Malaysian Customs Malaysia Goods And Gst

You can call 603 2712 3187 for assistance if your car breaks down or if you are involved in an accident or require medical assistance.

. 710-5455 De Gaspe Ave Montreal H2T 3B3 Winnipeg. Reimbursement of GST and any LCT on a vehicle can be made at any time after the vehicle has been purchased. If premium is paid in advance for 2 or 3 years policy tenure then you get a premium discount of.

Accident Sickness Medical Expense Under the Accident Sickness Medical Expense Travel insurance with COVID-19 covered compensates for the medical expenses incurred by the insured because of being diagnosed with COVID-19 outside the Republic of India during the trip duration is hospitalized. For example your employee contracted COVID-19 due to. Take advantage of the best maid insurance promotion in Singapore and get high personal accident benefits.

Malaysia Office Location Tel 603 6262 8468 Singapore Office Location. Weve accounted for the GST increment in 2023 too. Input tax incurred on medical expenses is not claimable under Regulation 26 of the GST General Regulations unless the expense is obligatory under the Work Injury Compensation Act WICA.

2010 11th Ave 7th Floor Regina S4P 0J3. Get 5 premium discount on the base premium if you buy a health insurance policy online Family Discount. 201 Portage Ave Suite 1800 R3B 3K6 Regina.

UOB OCBC DBS Maybank More. Fuel purchases claim form. Expenses that are not incurred.

Looking for the highest interest available for fixed deposits. Maid Protect360 - the first and the cheapest Domestic Helper Insurance in Singapore that gives financial savings on medical and dental costs. Reimbursement of expenses incurred for vehicle repairs arising from accident.

200-55 Village Centre Pl Mississauga L4Z 1V9 Edmonton. Knowing what expenses are not tax deductible might help company to minimise such expenses. Annual Premiums Inclusive of 7 GST 1 20.

Best Digital Locks in Singapore And Their Pros Cons. 200-55 Village Centre Pl Mississauga L4Z 1V9 Edmonton. Best Fixed Deposit Rates in Singapore 21 Oct 2022.

16143 142 St NW Edmonton T6V 0M7 Vancouver. 247 referral services hotline for road and medical assistance in West Malaysia 3. Certain expenses have often been refused a tax deduction even though for businessman they are regarded as necessary business costs.

1248-13351 Commerce Pkwy V6V 2X7 Quebec. 710-5455 De Gaspe Ave Montreal H2T 3B3 Winnipeg. 201 Portage Ave Suite 1800 R3B 3K6 Regina.

Use this form to claim a refund of the fuel excise and GST you paid on fuel. 16143 142 St NW Edmonton T6V 0M7 Vancouver. 1248-13351 Commerce Pkwy V6V 2X7 Quebec.

Claimable Amount for Inpatient and Day Surgery Co-insurance Percentage of Claimable Amount 0 - 5000. Complete an Application for refund under Indirect Tax Concession Scheme ITCS Fuel claim form NAT 3152. Inclusive of 7 GST Age Next Birthday.

Providing employers with the most value of the coverage with Enhanced Medical Benefits Rider giving free medical. There are however a list of medical expenses that you cannot claim from MediShield Life. The following are more common non-allowable expenses.

2010 11th Ave 7th Floor Regina S4P 0J3. The policy provides coverage against Medical expenses upto the limit.

Annex A 6 Tax Changes Tax Changes For Businesses S N Name Of Tax Change Current Treatment New Treatment Helping Businesses Cope With Rising Costs Pdf Free Download

Small Business Accounting 101 Basics Set Up Software 2022 Shopify Malaysia

All About Input Tax Credit Under Gst Ebizfiling India Pvt Ltd

Fact Sheet Income Tax And Gst Treatment Of Meal Expenses Issued 26 November 2021

How To Start Gst Get Your Company Ready With Gst

Pdf The Relationship Between Tax Evasion And Gst Rate

Busine St Partners Plt Chartered Accountants Malaysia Facebook

Gst In Malaysia Explained Goods And Service Tax Government Services Goods And Services

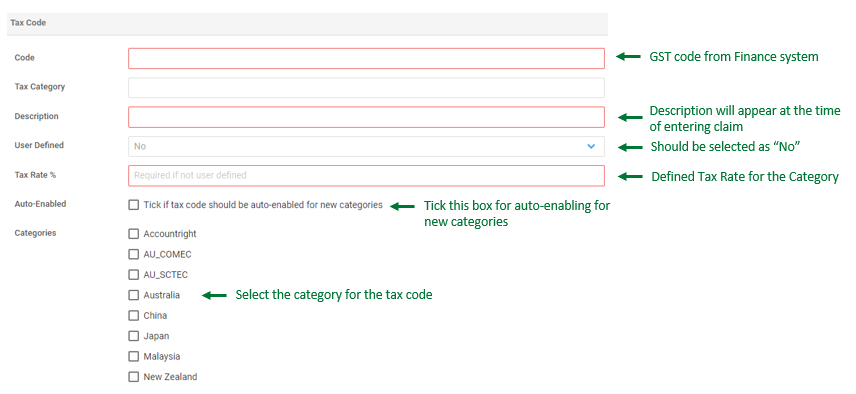

Non Deductible Tax Code Bl Sap Blogs

![]()

Can You Deduct First Class Tickets And How To Report Them Taxhub

Brochure Gst Practitioner Auditor Tax Agent Company Secretary Corporate Lawyers 26 27 January By Synergy Tas Issuu

Cash Vs Accrual Accounting Explained Xero Us

How To Claim Back Gst Gst Guide Xero Sg

Introduction To Gst For Smes In Malaysia

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

0 Response to "gst claimable expenses malaysia"

Post a Comment